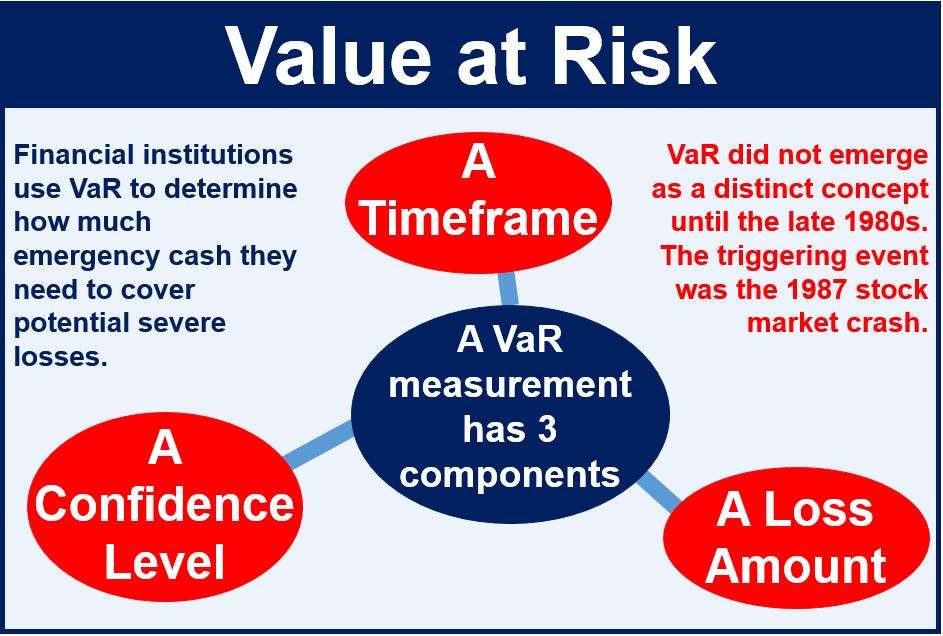

What Does 5 Var Mean . var can be calculated using different techniques. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. the value at risk (var) uses both the confidence level and confidence interval. By providing a quantitative estimate of. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. A risk manager uses the var to monitor and control the. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period.

from marketbusinessnews.com

understanding var is crucial for investors and financial institutions seeking to manage risk effectively. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. var can be calculated using different techniques. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. By providing a quantitative estimate of. A risk manager uses the var to monitor and control the. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. the value at risk (var) uses both the confidence level and confidence interval.

What is value at risk (VaR)? Definition and meaning Market Business News

What Does 5 Var Mean A risk manager uses the var to monitor and control the. A risk manager uses the var to monitor and control the. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. var can be calculated using different techniques. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. By providing a quantitative estimate of.

From www.youtube.com

VAR The System Explained YouTube What Does 5 Var Mean var can be calculated using different techniques. the value at risk (var) uses both the confidence level and confidence interval. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. By providing a quantitative estimate of. A risk manager uses the var to monitor and control the. value at risk is a. What Does 5 Var Mean.

From analystprep.com

Value at Risk (VaR) CFA, FRM, and Actuarial Exams Study Notes What Does 5 Var Mean value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. By providing a quantitative estimate of. the value at risk (var) uses both the confidence level and confidence interval. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. A risk manager. What Does 5 Var Mean.

From www.niceideas.ch

Chapter 17. Portfolio Optimization theory What Does 5 Var Mean value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. the value at risk (var) uses both the confidence level and confidence interval. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period.. What Does 5 Var Mean.

From www.codecademy.com

Variable Types Variable Types Cheatsheet Codecademy What Does 5 Var Mean understanding var is crucial for investors and financial institutions seeking to manage risk effectively. A risk manager uses the var to monitor and control the. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. By providing a quantitative estimate of. var can be. What Does 5 Var Mean.

From chargebacks911.com

VAR Sheets Get All Your Documents Ready in 4 Basic Steps What Does 5 Var Mean value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. . What Does 5 Var Mean.

From www.espn.com.au

The ultimate guide to VAR in the Premier League all your questions answered What Does 5 Var Mean value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. var can be calculated using different techniques. A risk manager uses the var. What Does 5 Var Mean.

From corporatefinanceinstitute.com

Value at Risk Learn About Assessing and Calculating VaR What Does 5 Var Mean the value at risk (var) uses both the confidence level and confidence interval. By providing a quantitative estimate of. var can be calculated using different techniques. A risk manager uses the var to monitor and control the. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. value at risk (var) is. What Does 5 Var Mean.

From www.studocu.com

Calculator 1var guide TI84 Guide 1Var Stats ENTERING DATA Press [stat], go to 1 Edit What Does 5 Var Mean the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. value at risk is a statistical metric that. What Does 5 Var Mean.

From www.espn.com

The ultimate guide to VAR in the Premier League all your questions answered ESPN What Does 5 Var Mean understanding var is crucial for investors and financial institutions seeking to manage risk effectively. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. var can be calculated using different techniques. . What Does 5 Var Mean.

From www.youtube.com

What does var mean in Javascript? (2 Solutions!!) YouTube What Does 5 Var Mean By providing a quantitative estimate of. var can be calculated using different techniques. A risk manager uses the var to monitor and control the. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. understanding var is crucial for investors and financial institutions seeking to manage. What Does 5 Var Mean.

From www.slideserve.com

PPT VAR and VEC PowerPoint Presentation, free download ID1274667 What Does 5 Var Mean value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. By providing a quantitative estimate of. understanding var is crucial for investors and. What Does 5 Var Mean.

From blog.edtechie.net

The VAR lessons for Ed Tech The Ed Techie What Does 5 Var Mean value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such.. What Does 5 Var Mean.

From www.animalia-life.club

Constants And Variables In Math What Does 5 Var Mean value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. By providing a quantitative estimate of. value at risk (var) is a financial metric that estimates the risk of an. What Does 5 Var Mean.

From stackoverflow.com

What does var Var mean in a uml digram and how would I write it in java? Stack Overflow What Does 5 Var Mean By providing a quantitative estimate of. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. A risk manager uses the var to monitor and control the. understanding var is crucial for investors. What Does 5 Var Mean.

From thepfsa.co.uk

VAR Explained What is it and How Does it Work? The PFSA What Does 5 Var Mean var can be calculated using different techniques. A risk manager uses the var to monitor and control the. the value at risk (var) uses both the confidence level and confidence interval. value at risk is a statistical metric that forecasts the highest possible loss and the probability of it occurring over a particular period. By providing a. What Does 5 Var Mean.

From www.sportzcraazy.com

VAR (Video Assistant Referee) Everything About VAR and Its Use in Football What Does 5 Var Mean understanding var is crucial for investors and financial institutions seeking to manage risk effectively. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. value at risk is a statistical metric that. What Does 5 Var Mean.

From learningschoolinsitovp.z22.web.core.windows.net

Types Of Science Variables What Does 5 Var Mean value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. value at risk (var) is a statistic that is used in risk management to predict the greatest possible losses over a. value at risk is a statistical metric that forecasts the highest possible loss and the. What Does 5 Var Mean.

From en.ppt-online.org

Value at Risk online presentation What Does 5 Var Mean var can be calculated using different techniques. understanding var is crucial for investors and financial institutions seeking to manage risk effectively. the value at risk (var) uses both the confidence level and confidence interval. value at risk (var) is a financial metric that estimates the risk of an investment, a portfolio, or an entity, such. A. What Does 5 Var Mean.